How Does 1031 Exchange work in investment?

Home » How Does 1031 Exchange work in investment?

- Bryant

- Jul, 21, 2021

- Newsletter

- No Comments

What is a 1031 exchange?

1031 Exchanges are also known as Like-Kind Exchanges (LKE)

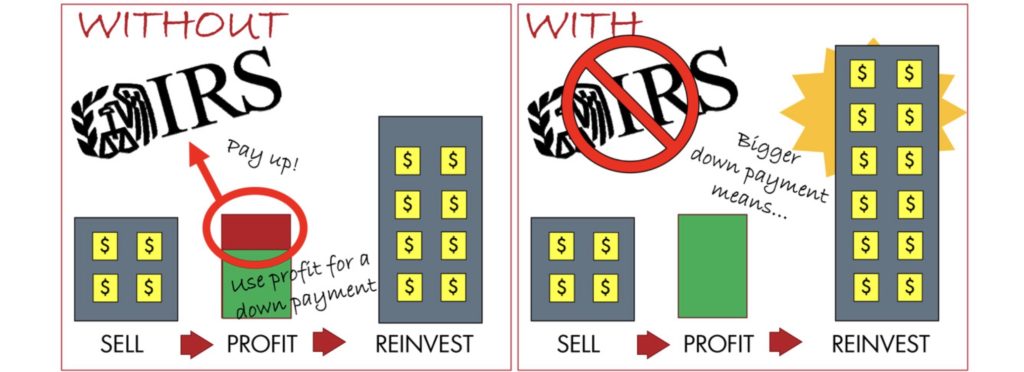

Generally, capital gain tax will occur after homes were sold.

However, if the sale is only a conversion of an investment and the investor completes the sale of the “original property” and acquires the “like-kind property” in exchange within a limited period of time, the value added by the investor on the sale of the “original property” is not taxed in the same year. No tax is due in the year of the sale of the “original property” but is deferred until the sale of the “like-kind property” acquired in exchange. With a 1031 exchange (IRC Sec 1031), no capital gains tax is due at the time of sale.

There is no limit to this type of investment, which means that the property can be sold and bought continuously without paying capital gains tax, and can theoretically continue to be taxed until the final sale for cash.

Or when the investor rest in peace, the capital gains tax that has not been paid before will not have to be paid.

In addition, when the heirs get the investor’s property, the value of the house will be calculated at the time of the property inheritance, not when the investor bought it that year.

The U.S. tax code encourages investors to invest in U.S. real estate by allowing overseas investors to use the 1031 exchange to obtain tax benefits in addition to U.S. citizens and legal permanent residents.

Types of Real Estate Investments Subject to the 1031 Act

Not all investments are eligible for 1031 exchanges. The Act applies only to investments in the United States and to Real Estate Property used for commercial purposes!

Commercial use means holding real estate for trade, business or investment, including rental residences, office buildings, farmland and commercial real estate.

The exchange of property must be of the same nature, but can be of a higher or lower quality or class. For example, an apartment building can be exchanged with an office building, rental housing can be exchanged with land, land can be exchanged with a warehouse, etc.

Purchases and sales of property that cannot be used for personal use, such as owner-occupied houses, second homes (owner-occupied) and vacation homes, do not qualify for similar exchange treatment.

Real estate in the U.S. and real estate outside the U.S. are not the same type of real estate and do not qualify for a “1031 exchange. For example, selling a Chinese property and purchasing a U.S. property.

1031 Requirements

Identification Period, 45 days, within 45 days of the sale of the property, the investor must identify a replacement property, i.e., find the house they want to buy. The investor must select the property needed for the second transaction in writing and submit it to the other party to the second transaction or to a third party intermediary.

The Exchange Period, 180 days, must be completed within 180 days and cannot be overdue.

“The three principles of the 1031 Exchange

The principle of three properties: for example, if the investor does not have more than three properties to purchase, there is no limit to the total market value of the selected properties.

The 200% principle: if the investor wants to buy more than three houses, the total market value of the selected house cannot exceed 200% of the market value of the property sold.

The 95% rule: on the basis of the "200% rule", if the total market value of the house to be purchased exceeds 200% of the market value of the property for sale, then the total market value of the property finally purchased by the investor must be at least 95% of the total market value of the house previously selected.*The “house” in the above example can be a Real Estate Property for other investment and commercial purposes.

Good news! GPS offers exclusive off-market deals of real estate listings, you don’t have to compete with buyers in the market. If you have any questions or thoughts about buying, selling or renting a home in Seattle, please reach us @ (425) 243-5082, hi@gpsrenting.com,

Or add us on WeChat @ GPSSeattle to talk about your needs!

Wish everyone to stay healthy and the Pandemic will be over soon! GPS Renting is a Seattle Property Management Company.