Property taxes are levied on the value of the property and are generally collected by the county in which the property is located in Washington State. Washington State property taxes can be paid twice a year, the first half of the tax must be paid by April 30th and the second half by October 31st. Otherwise, it will be called delinquent on November 1st, and the interest rate will be 1% per month.

In fact, you don’t need to pay your property taxes with a professional CPA, you can pay it yourself and just need to pay online according to the prompts! Below we will explain how to pay your taxes.

Find the County

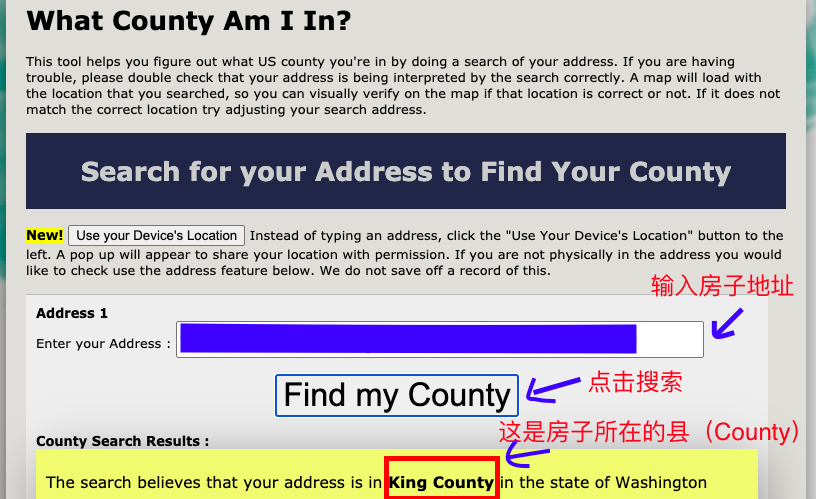

Before paying taxes, we need to know which county the house belongs to, each county has its own government website, we can go to that county’s government website to pay taxes. (If you know which county your house belongs to, please skip this step.)

Copy the following website, then enter the address of the property and click on “Find County for Address” and it will show you the county where the property is located.

http://www.whatcountyamiin.com/

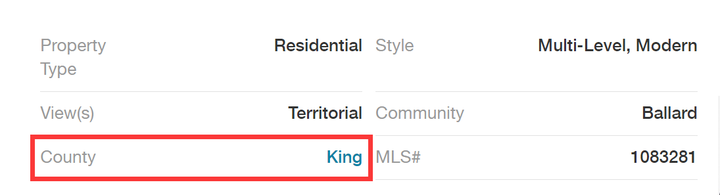

You can also find it on the details page of real estate websites such as rendfin.com

Now that you know which county your house belongs to, for those who are purchasing a home in the Seattle area, GPS Real Estate will focus on two counties: King County and Snohomish County. (If the house belongs to another area, you can also pay on the government website of that area, the process is similar)

King County

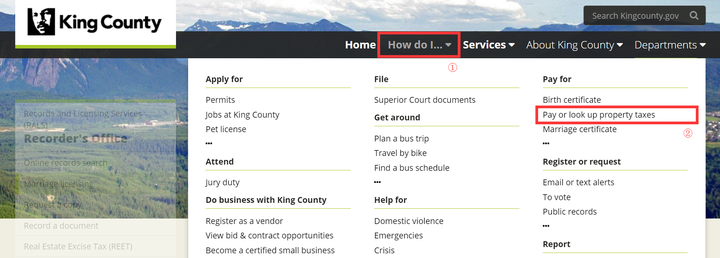

- Find the county’s tax payment page

Open King County’s government website and click on the location in the picture to find the payment page.

URL: http://www.kingcounty.gov

You can also access the tax payment page by copying the following URL:

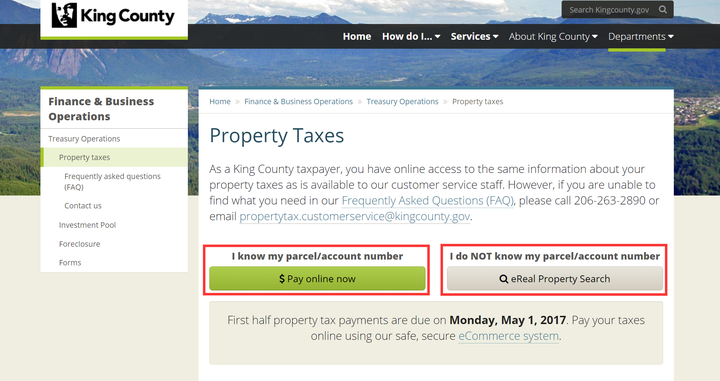

URL: http://www.kingcounty.gov/depts/finance-business-operations/treasury/property-tax.aspx

- Find the parcel number of the property

If you don’t know the parcel/account number of the property, click the button on the right side of the tax payment page to find out the parcel number.

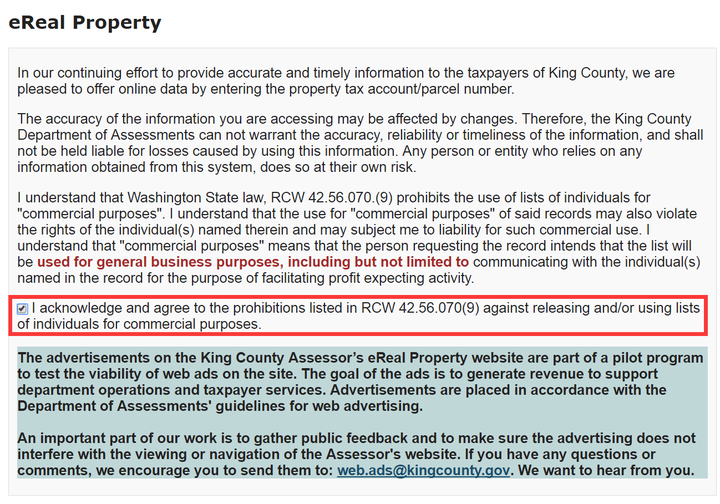

We will jump to a prompt page first, click agree and enter the search page.

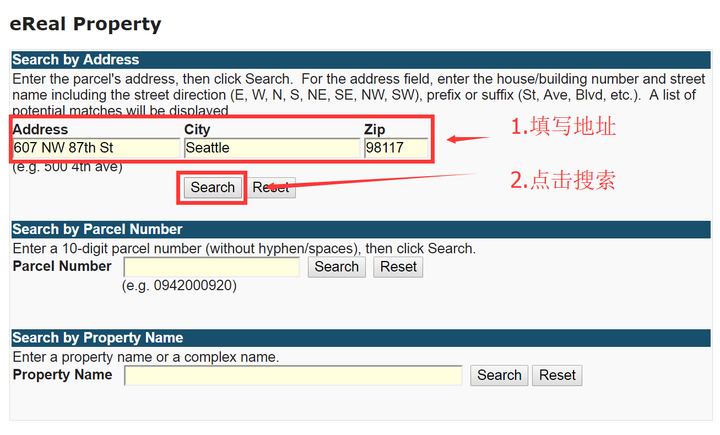

Fill in your property address in the search page, click “Search”, and we will enter the property details page.

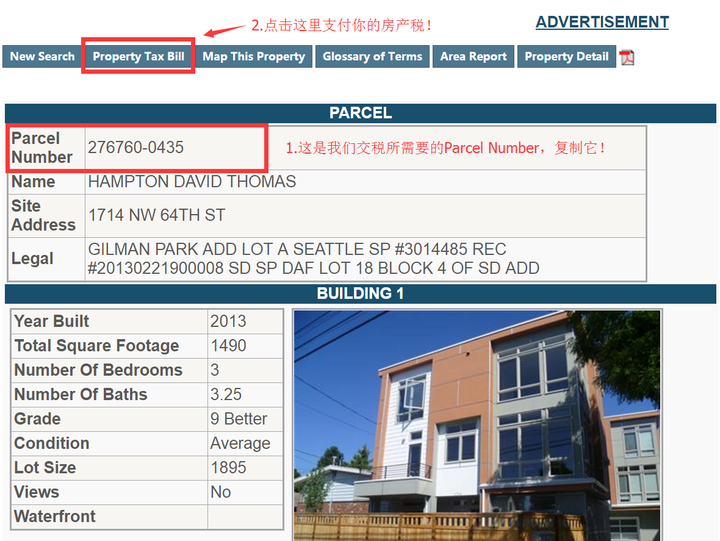

The first information is the Parcel Number we need, copy it! Click on “Property Tax Bill” to enter a new page.

- Select and pay the property tax

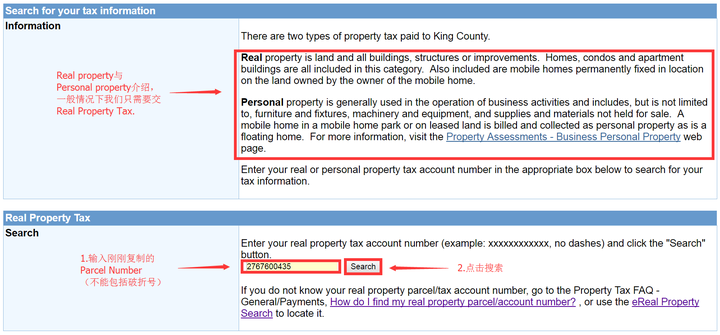

This page explains Real Property and Personal Property, for general investment property only need to pay Real Property Tax, in the Real Property Tax box fill in the just copied Parcel Number (generally will automatically fill in, can not include the dash) Click “Search” to start paying the tax!

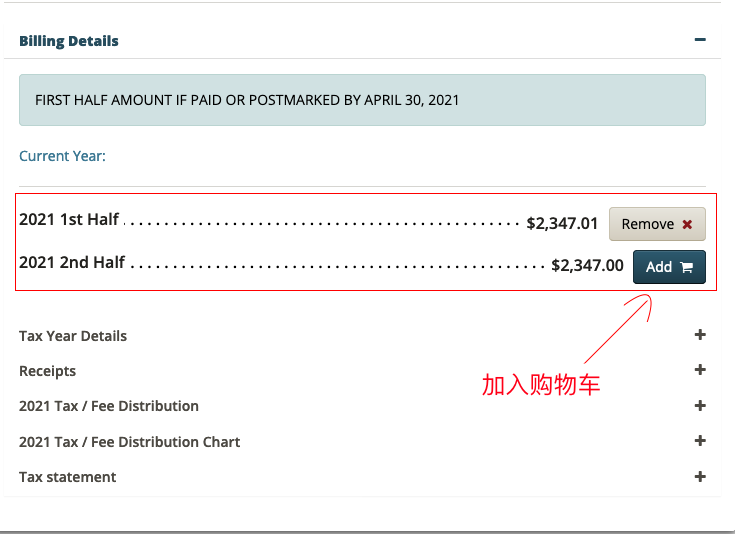

In King county, you can pay your annual property tax in two installments or all at once, select the property tax you want to pay, click “Add” to join and jump to the payment list.

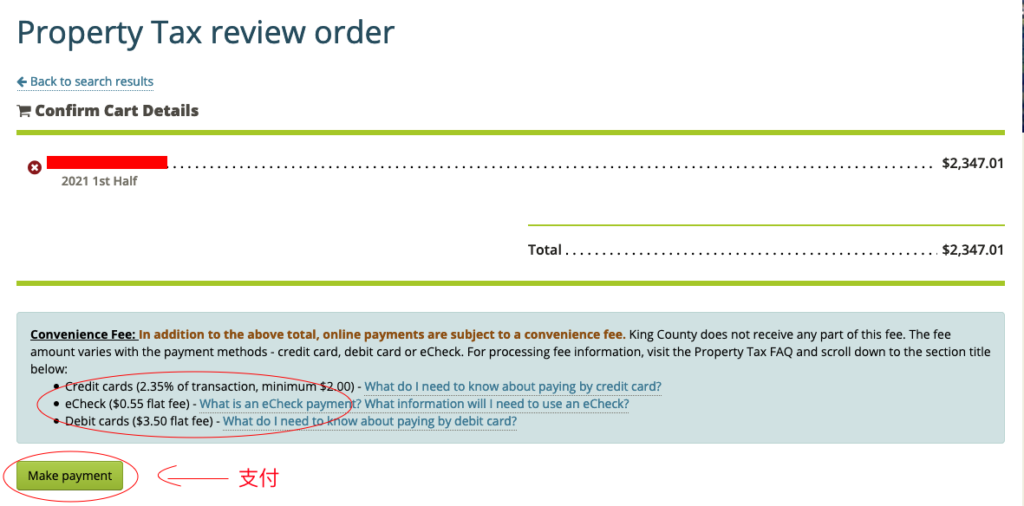

Enter the payment list, we will see a statement here, if you use credit card, you need to pay 2.35% handling fee, if you use E-check, you need to pay $0.55 handling fee, if you use debit card, you need to charge $3.5 handling fee, confirm it is correct and click Click “Make Payment” to enter the payment page.

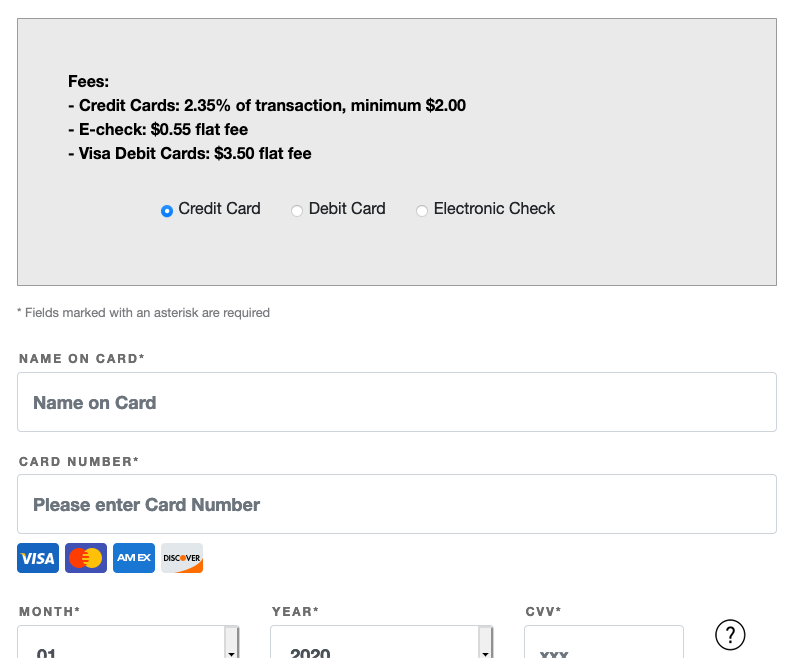

Select the payment type you want to use, fill in the payment information and complete the payment.

Snohomish County

- Find the county’s tax payment page

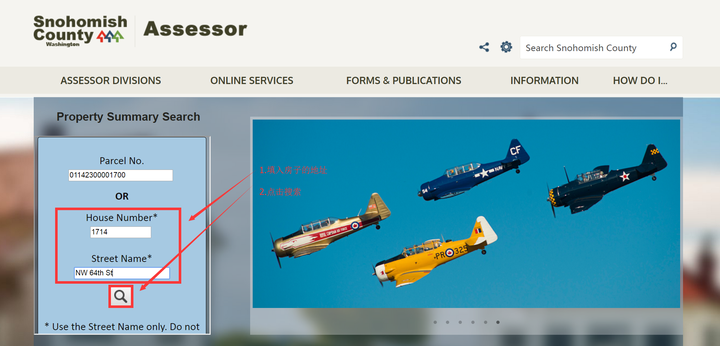

Open Snohomish County’s tax payment page on the government website by copying the following address and opening it directly.

URL: https://snohomishcountywa.gov/5167/Assessor

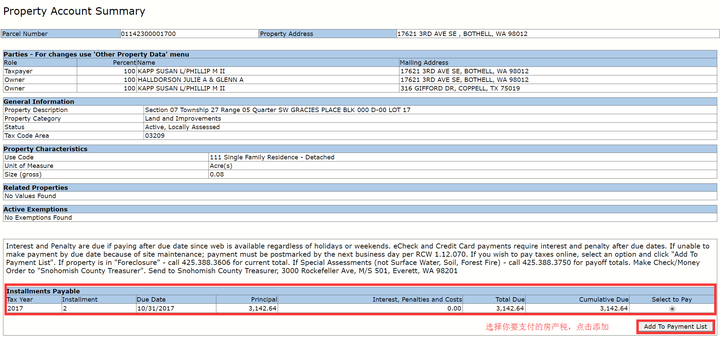

Enter the address of the property and click on the “magnifying glass” to search, which will bring you to the property details page.

- Select and pay your property tax

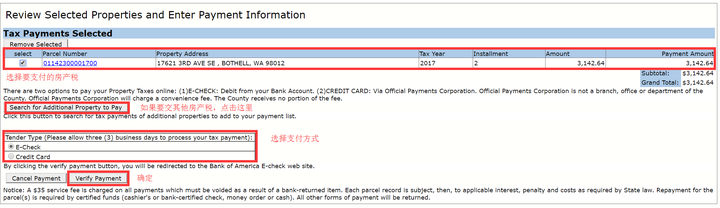

Select the property tax you want to pay, click “Add To Payment List” to join and jump to the payment list.

Select the amount you want to pay and the payment method, and click “Verfy Payment” to start the payment.

Note: If you receive an invalid check and it is returned, there will be a $35 service fee!

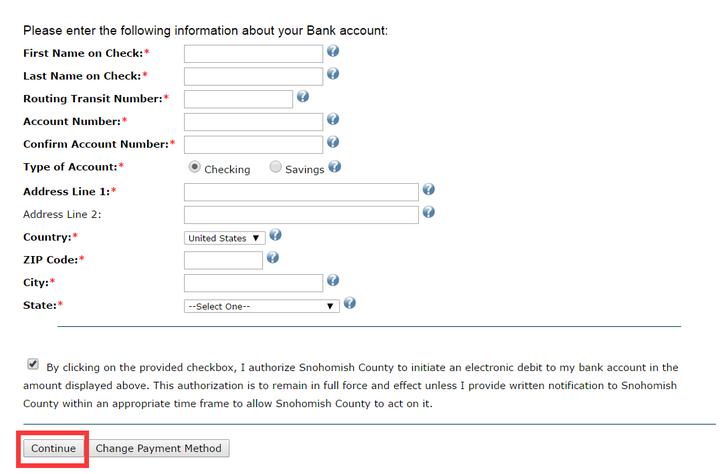

Select the payment method and click “Pay Now” to enter the payment page.

Fill in your check information on the payment page, click “Continue” after filling in your payment information and follow the instructions to complete the payment.

Other Questions

How do I pay my property tax bill?

Some customers may ask, “I am not in the U.S. and my property tax bill is due, what should I do? Usually the property tax bill will be sent directly to your home, you can pay by mailing a check to the designated location, or online.

What are the payment options for online payment?

Online payment can be made by E-check ($0.55) or credit card (2.35% fee). However, the most convenient and cost effective way is to pay by E-check, where you only need to enter your bank account number and routing number. It’s convenient, and you don’t have to pay extra fees (2.35%) like credit cards.

The U.S. is a very computerized country, so you can easily pay by electronic check wherever you are, whenever you have access to the Internet and the amount you need to pay.

If there is still something else you need to know, you can go to the King County government website.

Website: http://www.kingcounty.gov/depts/finance-business-operations/treasury/property-tax/faq.aspx

GPSRenting.com. We manage over 400 doors! Seattle full-service property management – No advertising fee! No tenant placement fee! No markup on maintenance! No lease renewal fee!

Good news! Seattle GPS offers exclusive off-market deals. of real estate listings, you don’t have to compete with buyers in the market.

If you have any questions or thoughts about buying, selling or renting a home in Seattle, please reach us @ (425) 243-5082, hi@gpsrenting.com

Or add us on WeChat: GPSSeattle to talk about your needs!

Wish everyone to stay healthy and the Pandemic will be over soon!